Alright, so you’re ready to hit the road with your trusty man and van operation. But before you rev up that engine, you’ve got to make sure you have the right insurance coverage to protect yourself and your business. Let’s face it, accidents happen, and without the proper insurance, you could find yourself in a world of hurt. But don’t worry, with the right insurance in place, you can rest easy knowing that you’re covered no matter what comes your way.

Key Takeaways:

- Commercial vehicle insurance: If you operate a man and van service using a commercial van, it’s crucial to have commercial vehicle insurance to protect your vehicle and business in case of accidents or damages.

- Public liability insurance: This type of insurance is important for protecting yourself and your business from potential claims or lawsuits by third parties for injury or property damage during your van operations.

- Goods in transit insurance: If you transport goods for clients, having goods in transit insurance can provide coverage for potential damage, theft, or loss of the items while in your care.

How to Choose the Right Insurance for Man and Van

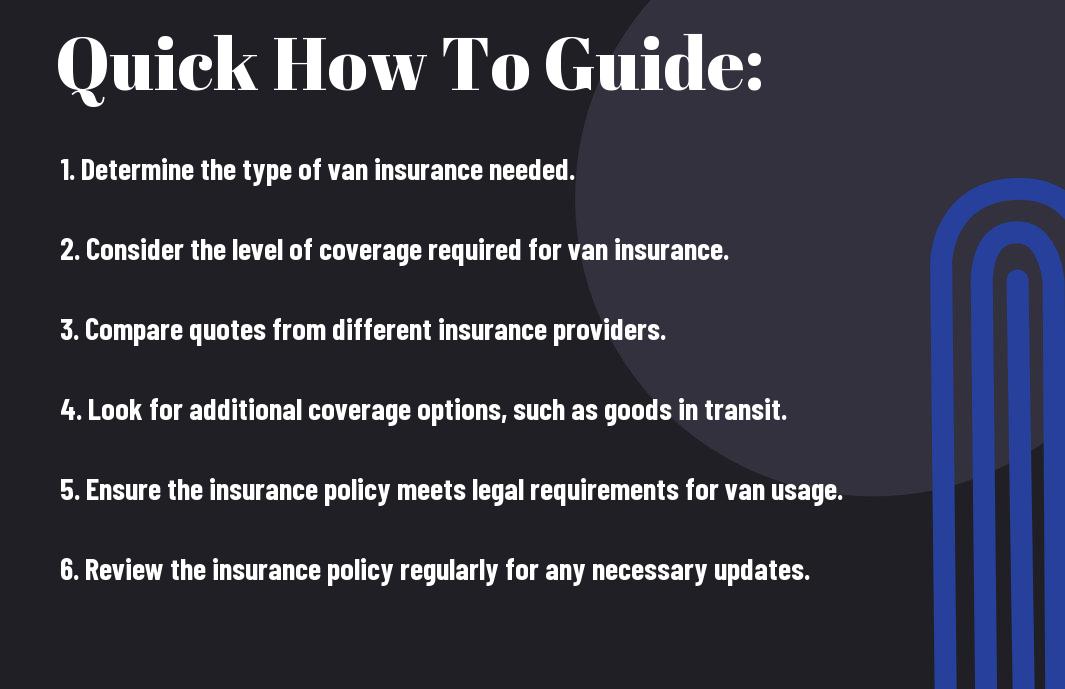

Obviously, finding the right insurance for your man and van business is crucial. It’s not just about protecting your livelihood, but also about complying with legal requirements. But with so many options out there, it can be overwhelming to figure out which insurance is the right fit for you. Here’s how to navigate through the options and make the best choice for your business.

Tips for Understanding Different Types of Insurances

When it comes to insuring your man and van business, there are a few different types of insurance that you should consider. Understanding the differences between them is key to ensuring that you have the right coverage for your specific needs. Here are some tips to help you wrap your head around it:

- Public liability insurance: This covers you for any claims made against you by members of the public for injury or property damage caused by your business activities.

- Goods in transit insurance: This covers the items you are transporting in case they are lost, stolen, or damaged during transit.

- Employer’s liability insurance: If you have employees, this is a legal requirement to cover claims made by employees for injury or illness sustained as a result of their work for you.

- Vehicle insurance: This covers you in case of accidents, theft, or damage to your van. It’s a legal requirement to have at least third-party insurance.

- Business interruption insurance: This covers you for loss of earnings if your business is unable to operate for a period due to an unexpected event.

After understanding the specifics of these types of insurance, you can tailor your insurance policy to fit your specific needs and risks as a man and van business.

Evaluating Your Risks and Choosing the Correct Coverage

Understanding the risks your business faces is essential to choosing the right insurance coverage. Whether it’s the risk of accident or injury during transportation, or the potential loss of income due to unforeseen events, assessing your risks will guide you to the perfect coverage for your business. Consider the type of goods you transport, the areas you operate in, and the number of employees you have. Being aware of the most important risks will help you make an informed decision about the right coverage for your man and van business.

Key Factors to Consider When Buying Insurance for Man and Van

Lastly, when it comes to buying insurance for your man and van business, there are a few key factors you need to consider to make sure you have the right coverage. Here are some important things to keep in mind as you weigh your options:

- The type of items you will be transporting

- The distance and frequency of your trips

- The level of protection you want for your vehicle and business

- The potential risks and liabilities involved in your work

Any decision you make about insurance for your man and van should be based on a thorough evaluation of these factors.

Importance of Cost Consideration

When considering insurance for your man and van, the cost is obviously an important factor to take into account. You need to ensure that the insurance premium fits within your budget, but remember, the cheapest option isn’t always the best. You should weigh the cost against the level of coverage and protection you will be getting. Ultimately, the goal is to find a balance between affordability and comprehensive coverage.

The Role of Policy Terms and Conditions

It’s crucial to carefully review the terms and conditions of any insurance policy you are considering for your man and van. Make sure you understand the extent of the coverage, any exclusions or limitations, and the process for filing claims. Pay close attention to the details, as they can have a significant impact on the protection your policy provides. Being aware of the specific terms and conditions will help you make an informed decision and avoid any surprises down the road.

Practical Tips when Dealing with Insurance Companies

To ensure that you get the best deal when it comes to man and van insurance, there are a few practical tips that you should keep in mind when dealing with insurance companies. Here are some important pointers to help you navigate the process and make sure you are adequately covered:

- Document everything: When interacting with insurance companies, it’s crucial to keep detailed records of all communications. This includes emails, phone calls, and letters. Having a clear record of your interactions can be invaluable in case of any disputes.

- Understand your policy: Make sure you thoroughly understand the terms and conditions of your insurance policy. This includes knowing what is covered, as well as any limitations or exclusions that may apply. If there are any aspects of the policy that you are unsure about, don’t hesitate to ask for clarification.

- Don’t settle for less: If you believe that you are entitled to a certain level of coverage or compensation, don’t be afraid to stand your ground and negotiate with the insurance company. It’s important to advocate for yourself and ensure that you are being treated fairly.

After following these practical tips, you can navigate the insurance process with confidence and secure the coverage that you need for your man and van operations.

How-to Negotiate with Insurance Providers

When it comes to negotiating with insurance providers, clear communication is key. Be prepared to articulate your needs and make a strong case for the coverage you require. Additionally, don’t be afraid to push back if you feel that the initial offer is inadequate. Remember, the goal is to reach a mutually beneficial agreement that meets your needs.

Ensuring You Get the Best Deal

To ensure that you get the best deal with insurance providers, it’s important to do your research and compare quotes from multiple companies. Additionally, consider factors such as the level of coverage offered, the deductible, and any additional perks or discounts that may be available. By being thorough in your approach, you can secure a policy that provides peace of mind at a competitive price.

Summing up

So there you have it, when it comes to running a man and van business, it’s crucial that you have the right insurance in place to protect yourself and your customers. While the specific type of insurance you need will depend on various factors such as the size and scope of your operations, it’s important to at least have public liability insurance and goods in transit insurance. Don’t wait until it’s too late to ensure you’re adequately covered – take the necessary steps to protect yourself and your business today.